What Happens To Stocks During War? (The Impact of War)

Impact Of War On The Stock Market

The one thing that I’m sure we can agree on is that the stock market does not like uncertainty.

The goal of most investors is to properly value stocks on any given day and buy them at prices they believe are fair, based on projections of future growth (i.e. revenue and profits).

Since no rational person wants to overpay for stocks, if future economic growth starts to look cloudy, the stock market will begin to reflect that.

And if one thing is for sure, war brings on a massive wave of uncertainty for the involved countries. Especially in the beginning.

Historic War Performance

How do stocks typically perform during wartime?

Well, it depends on a few factors.

Who is involved in the war?

Where is the location of the war?

How long will the war last?

What type of economic damage will the war bring?

How will the war impact the economy of each involved party?

A large war will require more resources in the form of labor and capital, which will likely take a toll on the overall economy in some form, depending on how long the war goes on and how well each countries economy can handle the financial burden of war.

For the sake of this blog post, we are going to focus on how the United States stock market has performed during times of war.

If a large war were to break out, companies that produce resources for the war (such as Boeing, Lockheed Martin, Raytheon, etc) would likely perform well due to the increase in government spending to purchase the new equipment needed.

However, historically there have been periods of both bull and bear markets during war.

So the short answer to “How does War Impact the Stock Market” is: it depends.

Let’s dive into the historical data!

Short-term Market Impact

The onset of geopolitical events almost always results in an initial crash in the stock market due to the initial uncertainty the crisis brings, as seen in the chart below.

Geopolitical Events And Stock Market Reactions

Anytime a global event brings uncertainty, the financial markets are going to get spooked.

That might not come as no surprise. The stock market craves certainty. How long each crash lasts depends on how long it takes for the market to gain more certainty of the future post-crisis.

It’s difficult for investors to project the future earnings of companies when the future becomes unstable due to global conflict.

So as you might guess, the bigger the conflict, the more market volatility will likely occur.

Long-term Market Impact

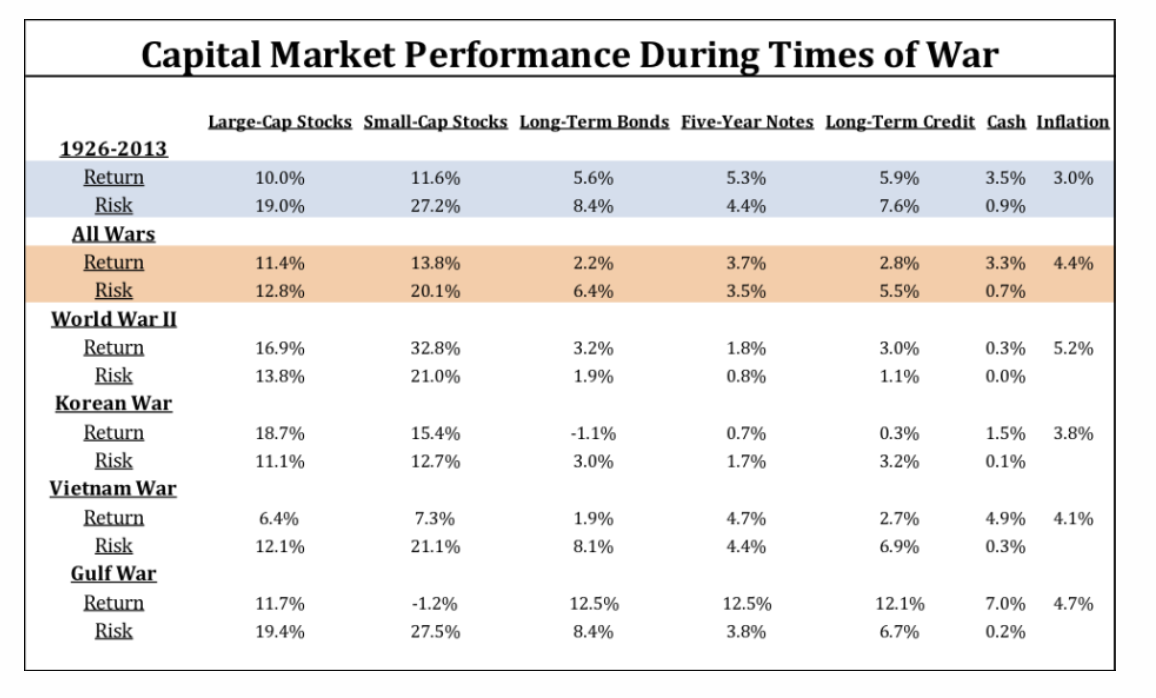

Over the long run, the U.S. stock market has historically performed well during wartimes, as seen in the chart below.

The full period of study, 1926 through July 2013, is shaded in blue and provides a “control” group for comparison. Periods of war are highlighted in red.

As surprising as it might sound, stocks have generally performed better than average during wartime. Of course, this has not always been the case.

Stock Market During The Vietnam War

How popular war is on the home front can likely influence the stock market’s reaction.

Low support for the Vietnam War likely contributed to specific stock market outcomes in the United States.

During the Vietnam War, stocks performed below the 10% per year historical average. Between 1965 and 1973, the stock market produced an annualized return of around 6.4%.

Stock Market During The Second World War

Using World War II as an example, stocks generally rose during one of the most violent wars the world has ever seen. With regular periods of volatility following initial war event shocks.

"From the start of World War II in 1939 until it ended in late 1945, the Dow was up a total of 50%, more than 7% per year. So, during two of the worst wars in modern history, the U.S. stock market was up a combined 115%," wrote Ben Carlson, Director of Institutional Asset Management at Ritholtz Wealth Management, in an article about counterintuitive market outcomes.

This could be due to a number of reasons. The most likely reason to me is that war increases government spending to pay for equipment and resources it needs for the war. Which in turn, results in more money entering the economy, which results in increased earnings for those companies that are awarded government contracts.

Considering Germany’s stock market post-World War II (as shown below), one might also be able to make the conclusion that the winning country’s economy tends to gain more global financial influence and with that a stronger stock market. While on the flip side, the losing country’s economy tends to lose more global financial influence and with that a weaker stock market.

Final thoughts: Impact Of War On The Stock Market

Investors have historically shrugged off wars after the initial shock of war.

Stocks have generally performed well during wartimes, especially stocks that benefit directly from war.

War and inflation usually come hand in hand, since financing wars are expensive. So Investors likely prefer investing in some sort of asset compared to holding cash that is losing value due to inflation, causing the stock market to continue to rise during times of uncertainty.

The length of war also plays a key factor. For example, the war in Afghanistan lasted nearly 20 years, during which markets saw both drastic crashes and historic highs. The longer a war goes on, the less the market reflects its influence, as the war eventually becomes just another part of the economy.

All that being said, past performance is no guarantee of future returns.

As long as the home economy stays in tack, and is not severely damaged (like Germany post WW2), Investors can assume that the war will just be a temporary burden on the overall economy, and might even benefit from the increased government spending if the economy can handle it.

Also, sign up for my email list to be the first to know when I publish a new blog post!

Want to keep learning? Check out some of my other blog posts:

As Always: Buy things that pay you to own them.

-Josh

Blog Post: #014