Build a “Set It and Forget It” Portfolio With These 7 ETFs

It’s never been easier to build a long-term “set it and forget it” portfolio, thanks to ETFs.

ETFs have made it easier for anyone to passively invest in the stock market without worrying about picking the right stocks.

What is a “Set it and forget it” investing strategy?

A “set it and forget it” investing strategy involves building a portfolio that includes well-diversified index funds, which allow you to step away from actively managing your investments.

In turn, this allows your investments to grow and compound over time without actively buying and selling individual stocks.

Not only is this strategy incredibly simple, but it has also historically outperformed most professional investors. According to a 2020 report, over a 15-year period nearly 90% of actively managed investment funds failed to beat the market.

What are ETFs?

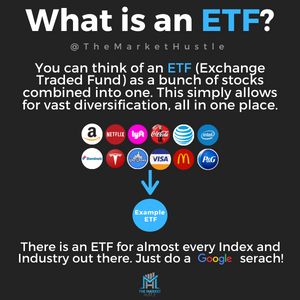

ETF stands for Exchange Traded Fund.

You can think of ETFs as a bunch of stocks combined into one stock, as seen in the picture below.

There are all types of ETFs out there in the investing world.

Some are complex (such as ETFs that use derivatives), and some are simple (such as ETFs that replicate Indexes).

Since everyone has different investment goals and risk tolerance, this blog post only intends to be used as an educational guide.

Some investors might prefer to invest in a single ETF, while others might prefer to invest in a mixture of different ETFs.

That decision is up to you based on your personal investment goals and risk tolerance. However, I did my best to include the pros and cons of each fund so that you can make a better investment decision.

ETFs VS Stocks

Although individual stocks can yield higher returns, they are riskier. Individual stocks can go out of business, are reliant on company-specific results, and may not perform well even if you spend hours on research.

ETFs allow investors to spread the risk of individual stocks amongst several stocks. If a few stocks go bankrupt or underperform due to company headwinds, your portfolio will barely feel the impact.

Build a “Set It and Forget It” Portfolio With These ETFs:

VOO - S&P 500 Fund (Large-Cap Companies)

VTI - Total US Stock Market Fund

QQQ - NASDAQ 100 Fund

VUG - Growth Stock Fund

VWO - Emerging Market Fund

VT - Total World Fund

VB - Small-Cap Fund (Small-Cap Companies)

What’s the difference between Large/Mid/Small cap companies?

Large-cap Companies: Companies with a $10 billion+ market valuation

Mid-cap Companies: Companies with a $2-$10 billion market valuation

Small-cap Companies: Companies with a <$2 billion market valuation

VOO - Vanguard S&P 500 ETF

Goal: VOO seeks to closely track the S&P 500 index's return by holding the 500 largest public companies in the United States.

Number of companies held: 504

Annual Expense Fee: 0.03%

Pros: The S&P 500 index is one of the most widely watched indexes around the world. It’s commonly used to gauge how the overall U.S. economy is doing.

Since its inception, the index has historically gained around 10% per year (some years less, some years more).

Cons: The fund is only invested in U.S. Stocks.

Although the S&P 500 only includes US-based companies, most of the companies operate in markets all around the world. It’s estimated that S&P 500 companies get roughly 40% of their revenue outside the U.S. (Source: Barrons).

If this concerns you, you may want to add some exposure to international stocks outside the United States.

Additionally, all of the companies held within $VOO fund are large companies. So no exposure is given to smaller companies.

The Top 10 Stocks Held In $VOO:

Pulled from Factsheet (March 2025)

VTI - Vanguard Total U.S. Stock Market Fund

Goal: VTI seeks to track the overall U.S. Stock Market's performance, including Mid-Sized and Small-Sized companies, unlike VOO.

Number of companies held: 3,609

Annual Expense Fee: 0.03%

Pros: If you’re looking for broad exposure to the U.S. Stock Market, this could be a good fund for you.

Cons: Although this fund includes Mid-Sized companies and Small-Sized companies, the fund is still dominated by large companies, just like VOO.

The Top 10 Stocks Held In $VTI:

Pulled from Factsheet (March 2025)

The top companies that dominate VOO also dominate VTI, resulting in almost identical historical performances between the two, as shown below.

Chart pulled from ETF.com (Data is current as of May 2023)

You’ll still be exposed to Mid and Small sized companies when you invest in VTI. Still, you might be better off adding concentrated exposure to Mid-sized and Small-sized companies if that’s what you’re really after.

Check out the fund’s fact sheet here for more information about VTI.

QQQ - Invesco QQQ Trust

Goal: QQQ tracks a modified-weighted index of 100 NASDAQ listed stocks.

Number of companies held: 101

Annual Expense Fee: 0.20%

Pros: This fund is excellent for those who want to take a more aggressive approach when it comes to investing.

QQQ only holds non-financial related stocks. So naturally, QQQ is dominated by tech stocks. QQQ has also historically outperformed the S&P 500, as seen In the chart below.

Cons: QQQ is much more volatile compared to the S&P 500. Mostly due to the concentrated exposure it has to technology companies. So if you don’t have the stomach to deal with this fund's additional volatility, you may want to avoid QQQ.

QQQ also has an expense ratio of 0.20%. Still relatively low, but less low than VOO.

I think QQQ is still a great way to invest more aggressively if that’s what you want. Especially if you are younger and have a longer time horizon.

You can check out the fund’s fact sheet here for more information about QQQ.

The Top 10 Stocks Held In $QQQ:

Pulled from Factsheet (March 2025)

VUG - Vanguard Growth ETF

Goal: VUG tracks the US Large-cap Growth Index, which selects large- and mid-size stocks with 6 growth characteristics.

Number of companies held: 179

Annual Expense Fee: 0.04%

Pros: This fund is concentrated in large-sized stocks with high growth potential. This is your fund if you’re looking for concentrated exposure to large, high-growth stocks.

Cons: Although growth stocks are great on the way up, they also get hit harder on the way down. So naturally, this fund will have more volatility, similar to QQQ. Additionally, this fund only invests in large-sized growth stocks (think Facebook or Tesla).

So if you want exposure to smaller-sized growth stocks, look elsewhere.

Check out the fund’s fact sheet here for more information about VUG.

The Top 10 Stocks Held In $VUG:

Pulled from Factsheet (March 2025)

VWO - Vanguard Emerging Market ETF

Goal: VWO tracks a market-weighted index of emerging-market stocks, excluding South Korea.

Number of companies held: 5,860

Annual Expense Fee: 0.08%

Pros: This fund is great for those who want to further diversify their portfolio and hedge against their local economy. Emerging market economies typically have a much higher growth potential than developed economies because they have more room for rapid growth.

As seen in the graph below, this fund includes stocks from all of the top emerging markets with the highest growth potential.

Pulled from Factsheet (March 2025)

Cons: Emerging markets tend to come with a basket of higher risks (currency risk, political risk, liquidity risk, etc) since they are economies that aren’t as stable as developed markets might be.

Although future economic growth can be better when it comes to investing in emerging markets, the risks are also generally higher.

Check out the fund’s fact sheet here for more information about VWO.

The Top 10 Stocks Held In $VWO:

Pulled from Factsheet (March 2025)

VT - Vanguard Total World Fund

Goal: VT tracks a market-weighted index of global stocks covering 98% of the domestic and emerging markets.

Number of companies held: 9,781

Annual Expense Fee: 0.07%

Pros: This is a well-diversified fund that covers a mixture of all major economies and emerging economies.

If you want to invest in a little bit of everything, this fund is for you.

Here is a breakdown of the top 10 economies this fund has exposure to:

Pulled from Factsheet (March 2025)

Cons: Although this fund is well-diversified, that diversification comes at a cost.

This fund has historically underperformed the S&P 500 over the long-term, as seen in the chart below.

Chart pulled from ETF.com (Data is current as of March 2025)

Nonetheless, this fund could still be a great addition if you’re looking to hedge your portfolio against political risk and economic risks in the United States.

Past performance never guarantees future performance.

So if you are unsure of the United States’ future, VT could be an excellent way to diversify into other economies.

Check out the fund’s fact sheet here for more information about VT.

The Top 10 Stocks Held In $VT:

Pulled from Factsheet (March 2025)

VB - Vanguard Small-Cap Fund

Goal: VB tracks the US Small Cap Index. The fund includes the bottom 15% of the smallest investable companies.

Number of companies held: 1,372

Annual Expense Fee: 0.05%

Pros: VB is an excellent fund if you’re looking to add exposure to smaller companies.

The fund captures the US small-cap space well. Smaller companies are considered riskier but tend to have more upside potential.

Cons: VB is only exposed to smaller-sized companies.

Because of that, this fund is considered much more volatile than the S&P 500. The fund has also historically underperformed the S&P 500, as seen below.

Chart pulled from ETF.com (Data is current as of March 2025)

Check out the fund’s fact sheet here for more information about VB.

The Top 10 Stocks Held In $VB:

Pulled from Factsheet (March 2025)

- Josh

If you want to learn how to build a long-term investing system you can actually stick to (without second guessing yourself) join my Money Mastery program.

As Always: Stack assets & enjoy life!

Blog Post: #015