The "Diversified" Mess

Diversification Isn’t a Strategy If There’s No Purpose Behind It

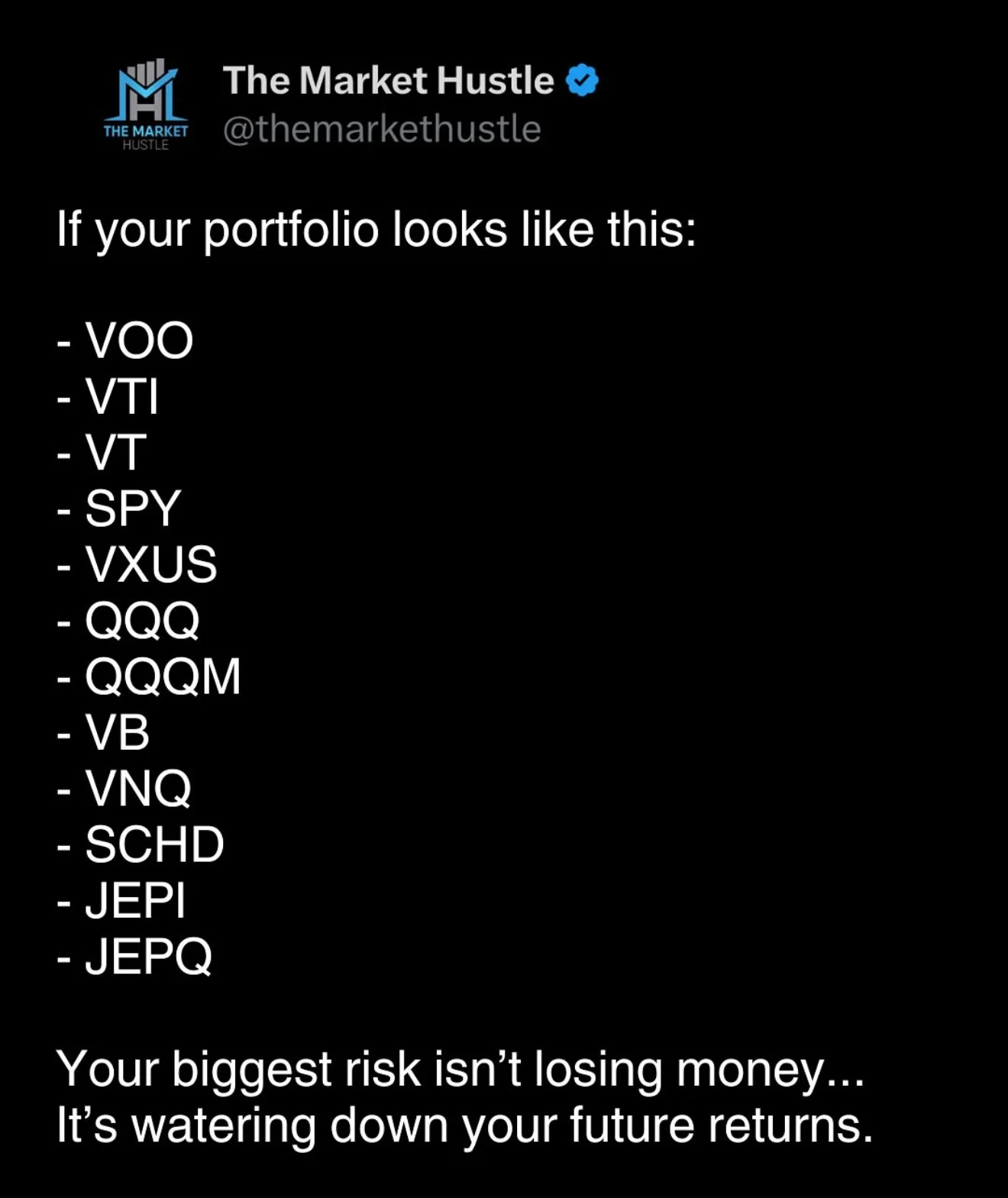

One of the biggest mistakes I see is people thinking more diversification is always better.

They learn about a new ETF, a real estate fund, or a dividend strategy and think it’s smart to keep stacking more.

But what they don’t realize is spreading across too many strategies might protect you from losses… but it can also block you from building anything meaningful.

When your money is scattered across 17 different ETFs, you’re essentially watering down your portfolio’s potential.

The investing magic doesn’t come from collecting strategies, It comes from concentrating your money around the result you actually want.

If you’re after growth, own funds that lean into growth.

If you’re wanting to generate income now, stack for dividends.

If you’re protecting wealth, build a defense strategy.

But trying to do all three at once is where people get stuck and pulled in different directions forever.

Think of it like this:

You’ve got 1 full tank of gas and 5 different cars.

If you spread the gas evenly, none of them go far.

But if you fuel one, you get to your destination with no problem.

Real diversification isn’t about doing more, it’s about aligning your money with a clear outcome.

My definition of diversification is spreading your money across the right assets to increase the odds of hitting your investing goals.

So ask yourself this:

What do you actually want your portfolio to do?

Once you’re clear on that, the strategy gets way easier.

The ETF Collector vs. The Intentional Investor

An ETF collector adds a new fund every time they hear about one that sounds good.

A new dividend ETF? Add it.

A tech ETF? Toss it in.

A real estate fund? Sure, why not.

Before you know it… you’re holding 12+ ETFs and you’re not even sure what half of them do.

It feels smart and safe. But what it really is doing is just adding fog to your goals.

Intentional investors play a different game…

They pick ETFs that match their actual goals and they stick to them.

Over the years, I’ve had a ton of people ask me to look at their portfolios and I’ve seen it all… People holding 3 different ETFs that track the same index or people chasing growth with dividend ETFs and not realizing they’re holding themselves back.

We’ve all been told diversification is how you don’t lose money.

But no one tells you that too much diversification can quietly kill your returns.

When you get intentional with a diversification strategy, two things happen:

Your portfolio gets simpler

Your confidence goes up

That way you’re not juggling 15 ETFs or switching strategies every time the market shifts.

We see market shift trends like this every cycle:

When stocks are red, everyone runs to dividends.

When things turn green again, they’re back to growth.

That’s not a strategy... That’s reacting to market movements.

And the more you react, the harder it is to build long-term momentum.

Growth, Income, or Defense? Pick Your Path

Most people never stop to ask the most important question:

What do I actually want from my investments?

They chase what’s trending, copy what their friends are doing, and blend five different strategies hoping it all works out.

But when you try to do everything at once, you spread your money too thin.

So let’s break down the 3 main investing approaches and who they’re best for:

1. Growth = Playing Offense

(S&P 500, Tech, Small-Caps, Growth ETFs)

You’re here to build wealth.

You’re not looking for stability or income. You’re optimizing for upside.

This works best if you’ve got time on your side and can stomach the short-term dips.

If you’re in your 20s or 30s, this is your zone.

The real risk at this stage isn’t volatility, it’s playing too safe and missing your window.

Don’t invest like you’re 65 if you’re 28.

2. Income = Steady Returns

(Dividends, REITs, Covered Call ETFs)

This lane is all about steady returns.

You’re not trying to double your money, you’re trying to generate consistent income from what you already have.

It’s a good fit if you’re nearing retirement or sitting on a large portfolio.

Just don’t be the person who panic-buys dividend stocks when the market drops… then rush back to growth when it pumps. That kind of investor flip-flopping destroys returns.

3. Defense = You Already Made It

(Treasuries, CDs, Commodities)

You’ve already built wealth. Now your job is to not lose it.

This is for late-stage investors who want to stay ahead of inflation without taking on unnecessary risk.

If you’ve hit 7 figures or are close to retirement, this lane makes sense.

But if you’re still building, this isn’t your game yet.

It’s not about what’s working for everyone else. It’s about what’s right for you.

At the end of the day, your portfolio should reflect your goals.

Not mine, your friend’s, or what’s trending on Reddit.

So take a second and ask yourself: What am I actually building this for? Why am I investing?

Simplification Is Your edge:

If your portfolio feels messy right now, here’s how to quickly clean things up without overthinking it:

1. Stick to 3–5 ETFs Max

Most people don’t need more than that.

It’s important to remember that each ETF holds hundreds (sometimes thousands) of different stocks.

I only hold 2 right now in my personal ETF portfolio:

One broad market fund

One tech fund

I’m considering adding a third soon, a small position in emerging markets as a long-term growth play. I’ll make an entire newsletter on that in the future.

2. Check for Overlap and Cut the Clutter

If you have multiple ETFs that are 80%+ the same, you’re usually just duplicating effort.

It’s like buying the same basket of stocks twice and thinking you’re diversified.

Use an ETF overlap tool to compare your ETFs and see how similar they are.

If two funds are nearly identical (and you didn’t mean for that to happen) pick one and move on.

No need to sell everything right away if you’re worried about taxes but at least stop adding to the clutter.

3. Label Each Portfolio with a Strategy

Every portfolio should have a purpose.

Ask yourself: Is this for growth? Income? Or defense?

Once that’s clear building the portfolio gets easier.

You stop wondering if you need another dividend fund or another tech ETF. You already know what you’re building and why.

At the end of the day, you don’t need 15 ETFs or 158 stocks to be a good investor.

You just need a system that’s clean, goal-driven, and easy to stick with.

Coming Soon: ETF Strategy Inside Money Mastery

One of the biggest reasons I created Money Mastery was to help people stop guessing and finally build a financial system they felt confident about.

Inside the system, you already get:

✅ An investor profile blueprint to help clarify how to build your strategy

✅ The ETF Playbook breaking down different funds and what they’re best used for

✅ My personal system for how I structure portfolios based on my goals

But I’ve got something new launching next week that takes this even further…

The ETF Strategy Dive 🎉

This new tool shows you exactly how to build an ETF plan that fits your goals. Whether you want to grow fast, generate income, or keep things simple, this will help you figure it out.

And the best part?

If you’re already a Money Mastery student you’ll get it free.

This is just another way I’m helping you cut through the noise and build wealth with confidence.

I can’t wait to roll it out.