SWTSX vs VTSAX - Which ETF Is Better?

*Data as of March 2025

Both SWTSX and VTSAX are titans when it comes to capturing a broad slice of the US stock market. They are designed to give investors a little taste of nearly every publicly traded company in the US.

But which one deserves the crown as the go-to option for your portfolio? Let’s find out!

SWTSX - Schwab Total Stock Market Index Fund

Goal: The objective of SWTSX is to mimic the performance of the Dow Jones U.S. Total Stock Market Index, which represents the entire U.S. stock market, including exposure to both small and large companies.

Number of Stocks held: 3,119

Dividend Yield: 1.28%

Annual Expense Fee: 0.03%

Benefits of SWTSX: The Schwab Total Stock Market Index Fund is a favorite for many because of its extremely low expense ratio. It offers wide exposure to the US market, covering not just the big companies, but also the smaller ones, giving investors a complete view of the US market's health and performance. With one of the lowest fees in the industry, it makes it an attractive choice for those who are fee-conscious.

Downsides of SWTSX: While SWTSX is a solid fund, it might not be the best choice for investors who want to hand-pick specific market segments. Also, because it captures the broader market, during volatile times, it can reflect larger market downturns.

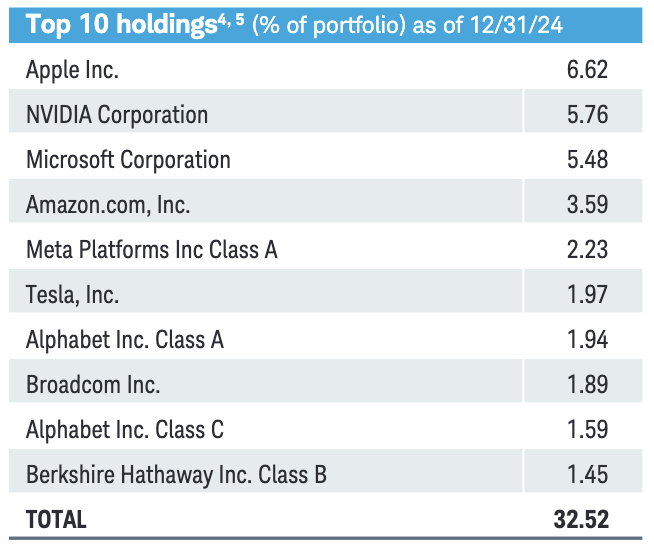

The Top 10 Stocks Held In SWTSX:

Pulled from SWTSX fact sheet in March 2025

VTSAX - Vanguard Total Stock Market Index Fund Admiral Shares

Goal: The primary goal of VTSAX is to track the performance of the entire U.S. stock market, just like SWTSX.

Number of Stocks held: 3,611

Dividend Yield: 1.25%

Annual Expense Fee: 0.04%

Benefits of VTSAX: VTSAX is a popular choice among many investors due to its wide coverage of the US stock market, from large giants to smaller businesses. Its reputation is backed by Vanguard's legacy and its commitment to keeping costs low. With its slightly higher dividend yield compared to SWTSX, it might be a better pick for those who prefer dividends.

Downsides of VTSAX: The annual expense ratio for VTSAX is a tad higher than SWTSX, even if it's just by a fraction. Also, just like SWTSX, it may not be suitable for those looking for more niche market exposures.

The Top 10 Stocks Held In VTSAX:

Pulled from VTSAX fact sheet in March 2025

Final Thoughts: SWTSX vs VTSAX

Both SWTSX and VTSAX are powerful options for investors looking to broadly tap into the pulse of the US stock market. The core difference lies in their tracking index - with SWTSX following the Dow Jones U.S. Total Stock Market Index and VTSAX shadowing the CRSP US Total Market Index. This index tracking difference gives VTSAX more exposure to different companies.

VTSAX has a slightly richer history and is backed by Vanguard's strong reputation in the investing world. In comparison, SWTSX comes with a marginally lower expense ratio and is part of Charles Schwab's suite of offerings.

These funds aren't designed to beat the market but to emulate it. Hence, they might not be the ideal picks for thrill-seekers but are solid options for those wanting stable, market-mimicking returns.

In essence, whether you lean towards SWTSX or VTSAX, you're positioning yourself to ride the ebbs and flows of the entire US stock market.

If you want to learn how to build a long-term investing system you can actually stick to (without second guessing yourself) join my Money Mastery program.

As Always: Stack assets & enjoy life!

-Josh

Blog Post: #134