SPMO ETF Explained: Is the S&P 500 Momentum Fund Worth Buying?

I've been getting a lot of questions about SPMO lately.

It's an S&P 500 Momentum ETF that's been crushing it recently, and naturally, people want to know if they should jump in.

So let me break down what SPMO actually is and how it works, so you can decide whether it deserves a spot in your portfolio.

What Is SPMO?

SPMO is designed to track the top 100 stocks in the S&P 500 with the strongest price momentum over the past 12 months.

Translation: It doubles down on what's already been going up.

Twice a year, SPMO reshuffles its holdings and picks the 100 S&P 500 stocks that have shown the highest price strength recently.

It doesn't care about fundamentals. It doesn't care about valuations. It just cares about recent performance.

Think of it as a "trend-chasing" version of the S&P 500.

Here are the current top 10 holdings (making up nearly 60% of the fund):

Source: SPMO Yahoo Finance (holdings as of Oct 2025)

The Upside of SPMO

SPMO can outperform when the market's in a steady uptrend and a handful of stocks are running hot (like recently).

I think of it like a disciplined "trading" strategy.

It follows a rule-based approach to ride momentum without you having to guess which stocks to chase.

And it's still focused on large U.S. companies, so you're not jumping into junk companies.

The Downside of SPMO

Here's where it gets tricky.

SPMO has high stock turnover.

It reshuffles twice a year on the third Friday of March and September, which means it's constantly chasing what's already gone up over the last 12-months.

The big risk is if momentum reverses quickly, this fund can underperform fast.

It's also less diversified than it looks.

Sure, it holds 100 stocks. But they're all concentrated trend based holdings.

If the trend breaks fast, they all can get hit harder before the fund rebalances.

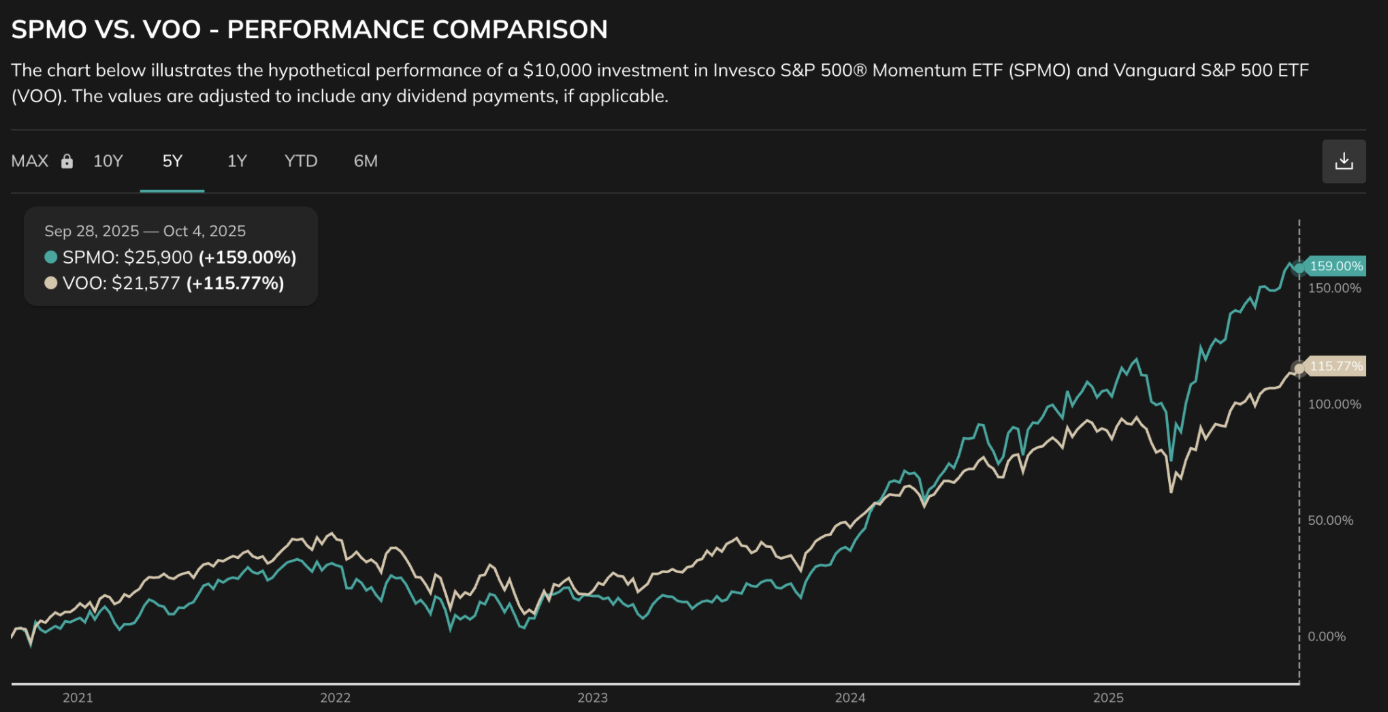

SPMO vs VOO: 5 year Performance Comparison

Source: Portfolios Lab

SPMO and VOO tracked pretty closely for several years, with each outperforming during different periods.

Only after the recent AI-driven tech rally did SPMO pull ahead more dramatically.

So yeah, it's been crushing it lately.

But that doesn't mean it always will.

Especially if momentum ever shifts fast in the opposite direction before the fund rebalances.

My Personal Take

SPMO is interesting. It's performed exceptionally well recently.

But it's essentially just chasing momentum from the previous 12 months.

It has better odds than trying to trade momentum yourself because it follows a disciplined approach.

The risk is if we get rapid changes in the market (if momentum shifts fast or volatility spikes quickly) momentum funds like SPMO can get hit harder than broader index funds since it's concentrated in volatile stocks.

The stocks that go up the fastest tend to also get hit the hardest when the market flips.

That's the risk you're taking with SPMO.

It doesn't hurt to have SPMO as a satellite position if you understand the risk.

But I wouldn't make it your core long-term position.

Chasing Performance vs Building a System

Here's the pattern I see over and over:

A fund crushes it for a few years, people pile in, then momentum reverses, and suddenly everyone's wondering what happened.

The problem isn't SPMO…

The problem is chasing recent performance without understanding what you're actually holding.

SPMO works when momentum is on your side.

But momentum can change quickly.

The investors who win long-term aren't the ones chasing the hottest fund.

They're the ones who built a system they can stick with through every market cycle.

That's what I teach inside Money Mastery: how to filter the noise, understand what you're holding, and build a portfolio that works for where you're at without guessing or gambling.

If you're tired of second-guessing every investment decision and want a clear system you can actually follow, join Money Mastery here.